canadian tax strategies for high income earners

We cant talk about tax strategies for high-income earners without mentioning real estate. AG Tax professionals have prepared a list of certain tax.

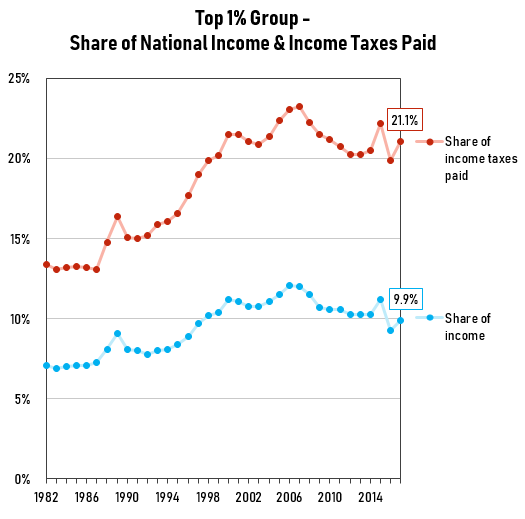

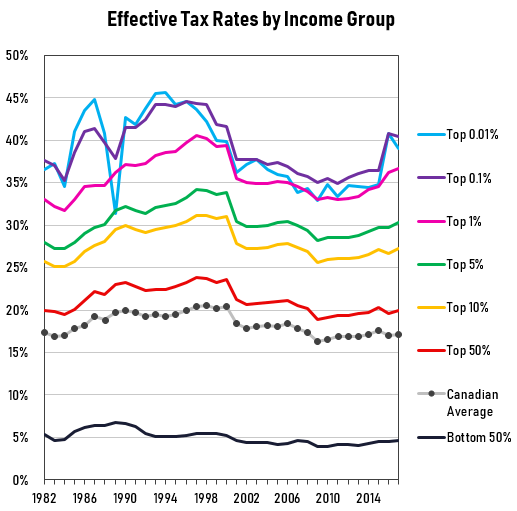

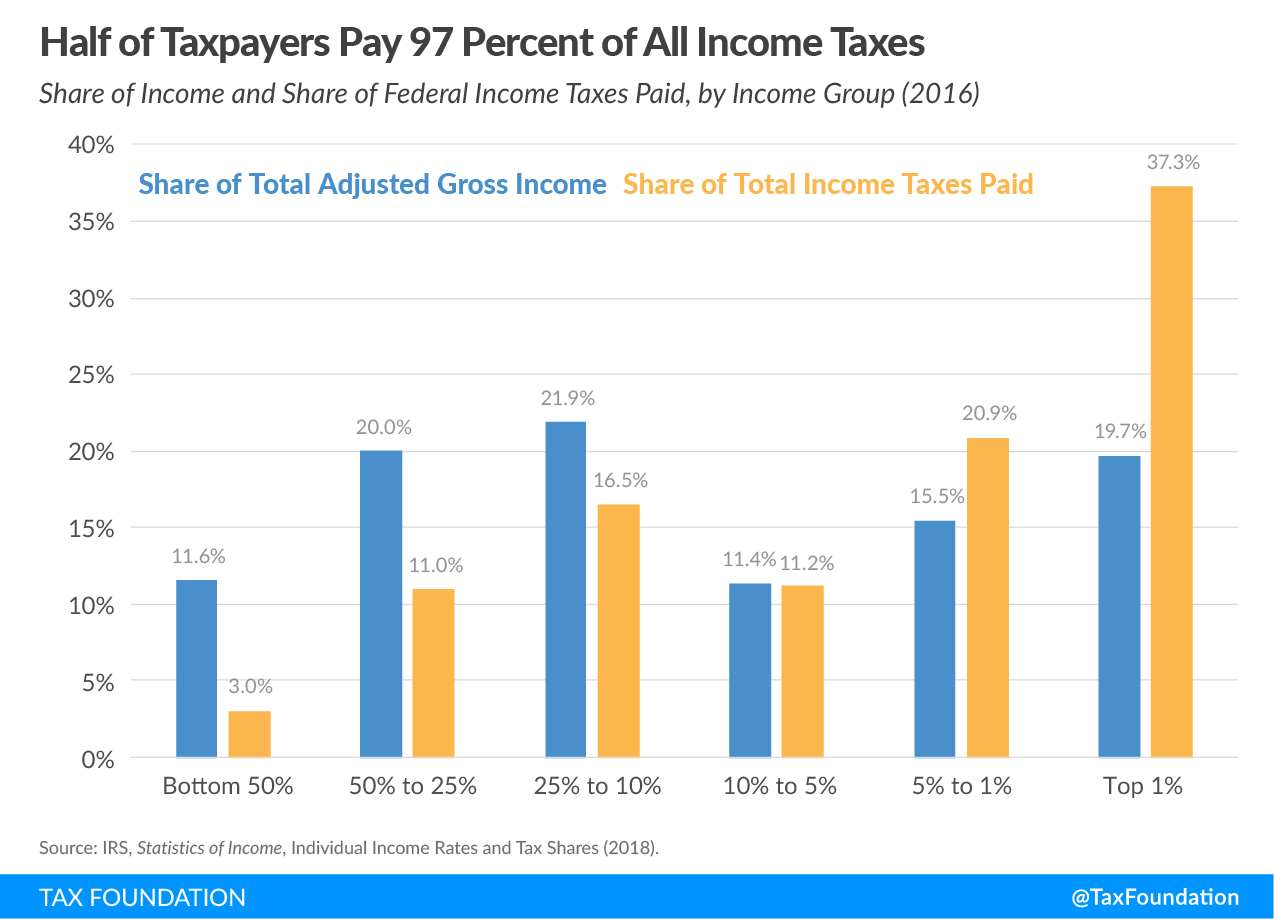

The Story Of The Rich Not Paying Their Fair Share Of Taxes Gis Reports

However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities.

. When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden. Health Savings Account Investing. Structure your investments tax efficiently.

Change the Character of Your Income One way to reduce your tax burden is to change the character of your income. Taxes associated with your investments are driven by the types of. One of the most popular tax-saving strategies for high-income earners involves charitable contributions.

Now may be an excellent time to purchase a home or opt for a cash-out refinance. Everyday tax strategies for Canadians. A family with two adults and three children will also have a very high tax rate.

The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. Utilize RRSPs TFSAs RESPs to the max. If theres potential for a high return by.

Canadian Tax Tricks There are numerous tax avoidance strategies which take advantage of rules offer generous tax breaks and are not frowned upon or illegal. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax. Here are some of our favorite income tax reduction strategies for high earners.

Its never too early to start tax planning for the New Year. Under RS rules you can deduct charitable. 5 things to get right.

In 2020 you can. These include IRAs 401Ks SEPs and other similar qualified. High income earners may have also considered conducting transactions between family and close friends as a tax planning strategy to avoid paying taxes.

Among the best tax strategies for high income earners is to benefit from the fact that any contributions made to tax-free savings accounts grow tax-free and there is no tax. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. If you wish to save tax.

For instance someone might. Done properly tax planning has the potential to minimize tax obligations. Vehicles for Reducing Your Lifetime Tax Bill Maximize Contributions to Deductible Tax-Deferred Accounts.

Tax minimization strategies for individuals Income splitting with family members Family income splitting is a fundamental tax planning strategy but many Canadians are not. Donate More to Charity. Tax Saving Strategies for High-Income Earners.

3 Tax-Saving Opportunities For High-Income Earners. To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will. Additionally tax-deferred accounts benefit by.

Do High Income Americans Pay Their Fair Share In Taxes Quora

Millionaires And High Income Earners Tax Foundation

Tax Strategies For High Income Earners 2022 Youtube

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

How To Reduce Taxes For High Income Earners In Canada Qopia Financial

How To Reduce Taxes For High Income Earners In Canada

Tax Planning For High Income Canadians Mnp

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Tax Strategies For High Income Individuals Youtube

High Income Earners Need Specialized Advice Investment Executive

Proposed Tax Changes For High Income Individuals Ey Us

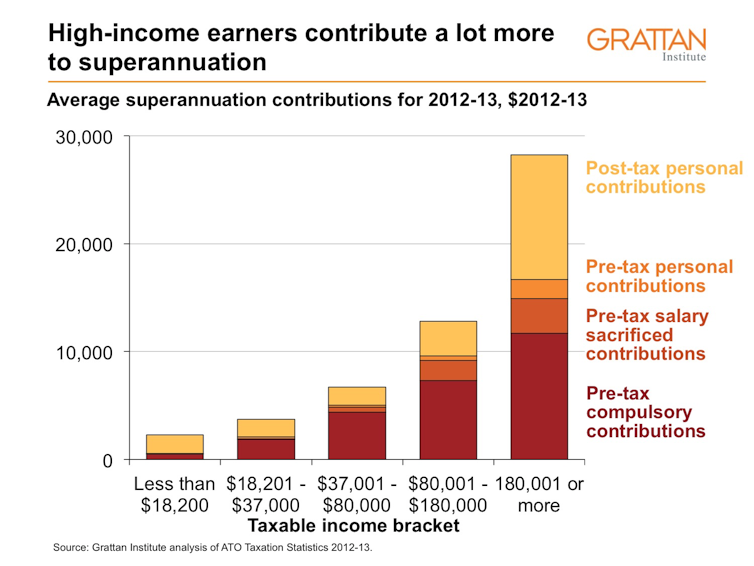

Catch Up Super Contributions A Tax Break For Rich Old Men

Millionaires And High Income Earners Tax Foundation

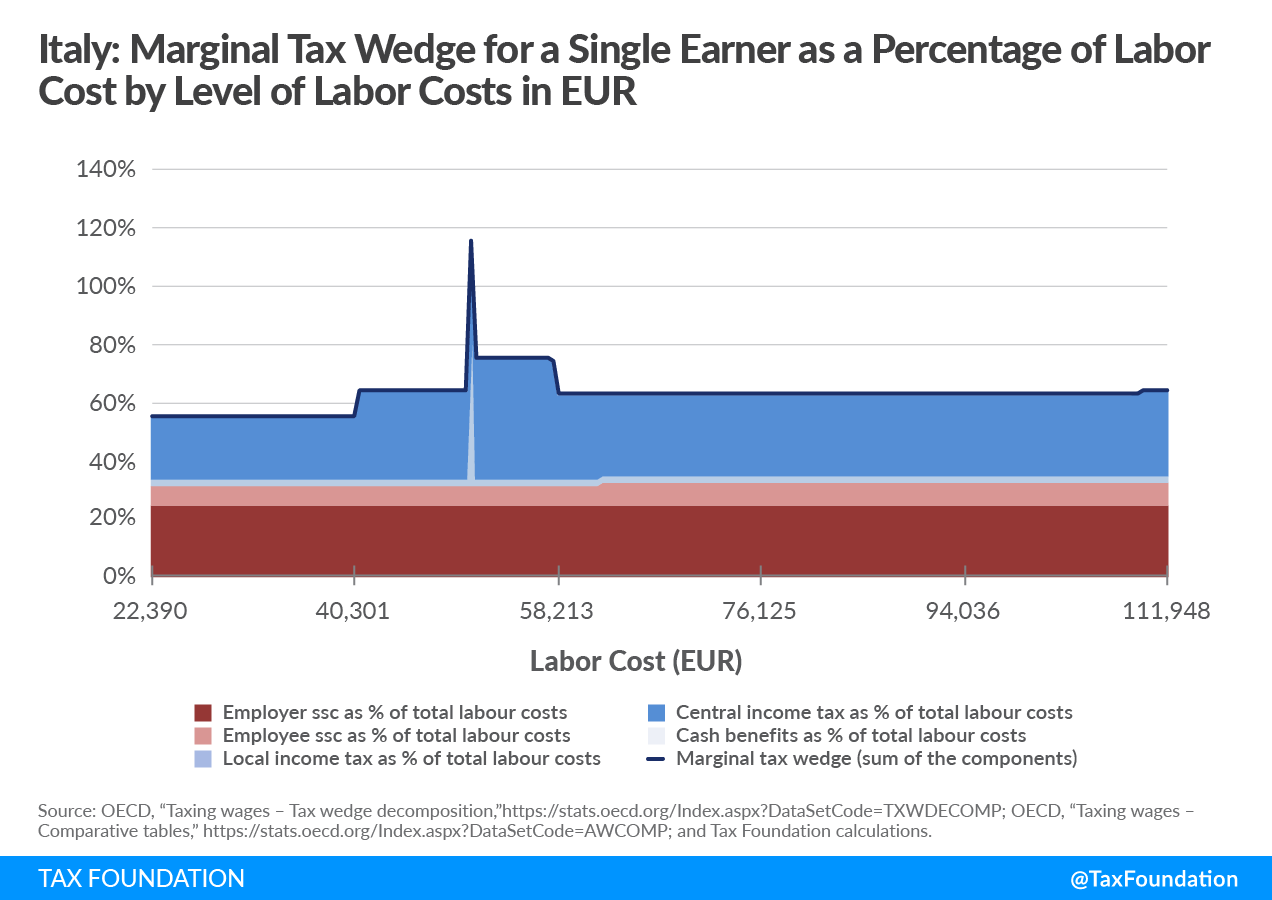

Italy Income Tax System Navigating Complex Income Taxes In Italy